aurora co sales tax rate

Aurora is in the following zip codes. The Aurora sales tax rate is.

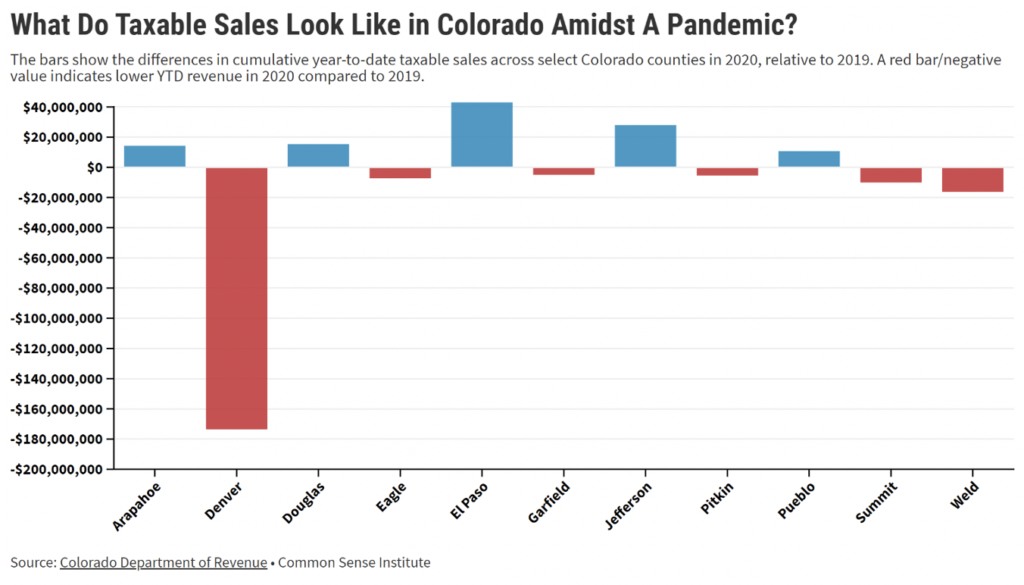

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora is in the following zip codes.

. Email email protected Google Translate Disclaimer. You can find more tax rates and allowances for Aurora and Colorado in the 2022 Colorado Tax Tables. The December 2020 total local sales tax rate was also 5500.

Alameda Parkway Aurora CO 80012. Sales Tax Breakdown Aurora Details Aurora OR is in Marion County. The December 2020 total local sales tax rate was also 0000.

You can print a 85 sales tax table here. The Nebraska sales tax rate is currently. Aurora and Denver are moving to exempt government fees such as the new Colorado tax on any retail delivery from municipal sales tax.

Did South Dakota v. The December 2020 total local sales tax rate was 8350. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

Sales Tax Breakdown Aurora Details Aurora NE is in Hamilton County. Avalara provides supported pre-built integration. Sales Tax Breakdown Aurora Details Aurora SD is in Brookings County.

Sales Tax Breakdown Aurora Details Aurora MO is in Lawrence County. Sales Tax Breakdown Aurora Details Aurora OH is in Portage County. The December 2020 total local sales tax rate was also 8000.

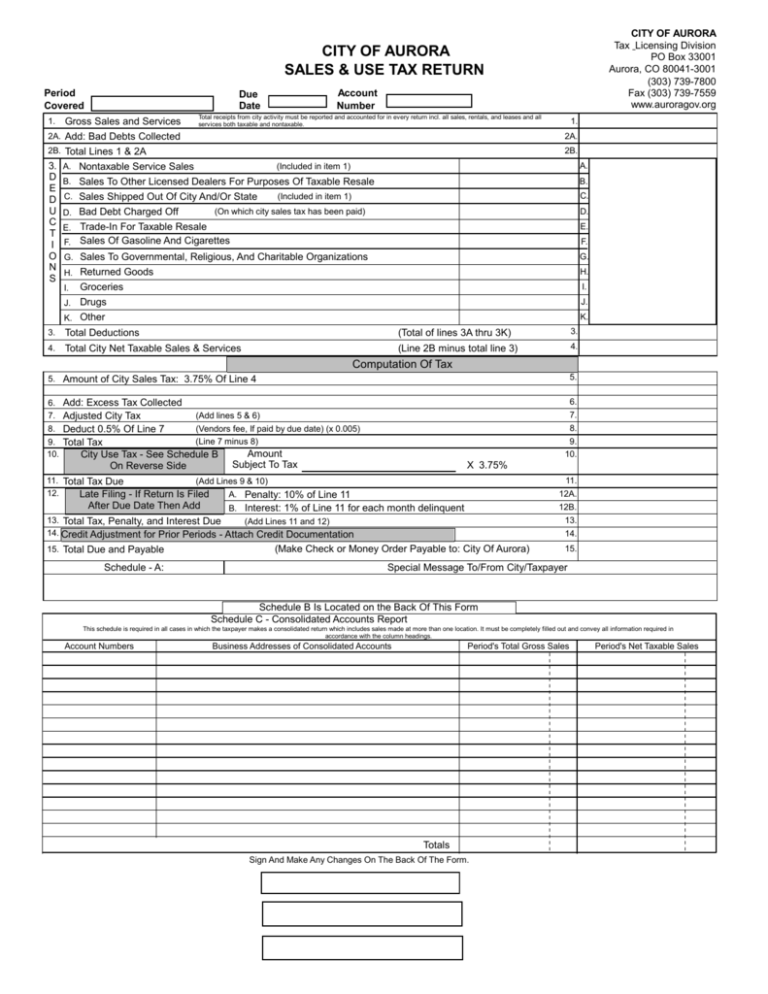

Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc. Aurora MO Sales Tax Rate The current total local sales tax rate in Aurora MO is 8850.

If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. Aurora is in the following zip codes.

The minimum combined 2022 sales tax rate for Aurora Nebraska is. Select the Colorado city from the list of popular cities below to see its current sales tax rate. Aurora CO Sales Tax Rate The current total local sales tax rate in Aurora CO is 8000.

City of Aurora Business Services Taxes Combined Tax Rates. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. File Aurora Taxes Online Tax Reminders.

With local taxes the total sales tax rate is between 2900 and 11200. This is the total of state county and city sales tax rates. In no event shall the amount of tax to be held be less than 375 400 in Arapahoe County of 50 of the permit fee determination assessment.

The December 2020 total local sales tax rate was 7250. Aurora Sales Tax Rates for 2022. Aurora is in the following zip codes.

Higher sales tax than 81 of Colorado localities 24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. Business Licensing and Tax Class. Colorado has recent rate changes Fri Jan 01 2021.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Special Event Tax Return. The current total local sales tax rate in Aurora NE is 5500.

Aurora is in the following zip codes. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe County. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51.

Get rates tables What is the sales tax rate in Aurora Nebraska. Aurora is in the following zip codes. 80010 80011 80012.

Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The current total local sales tax rate in Aurora OR is 0000.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. The County sales tax rate is. The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration use possess or have the right to use or possess any room or rooms in a hotel apartment hotel lodging house motor hotel guest house bed and breakfast.

Wayfair Inc affect Nebraska. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Aurora SD Sales Tax Rate The current total local sales tax rate in Aurora SD is 5500.

Aurora OH Sales Tax Rate The current total local sales tax rate in Aurora OH is 7000. The December 2020 total local sales tax rate was also 5500. Colorado CO Sales Tax Rates by City The state sales tax rate in Colorado is 2900.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

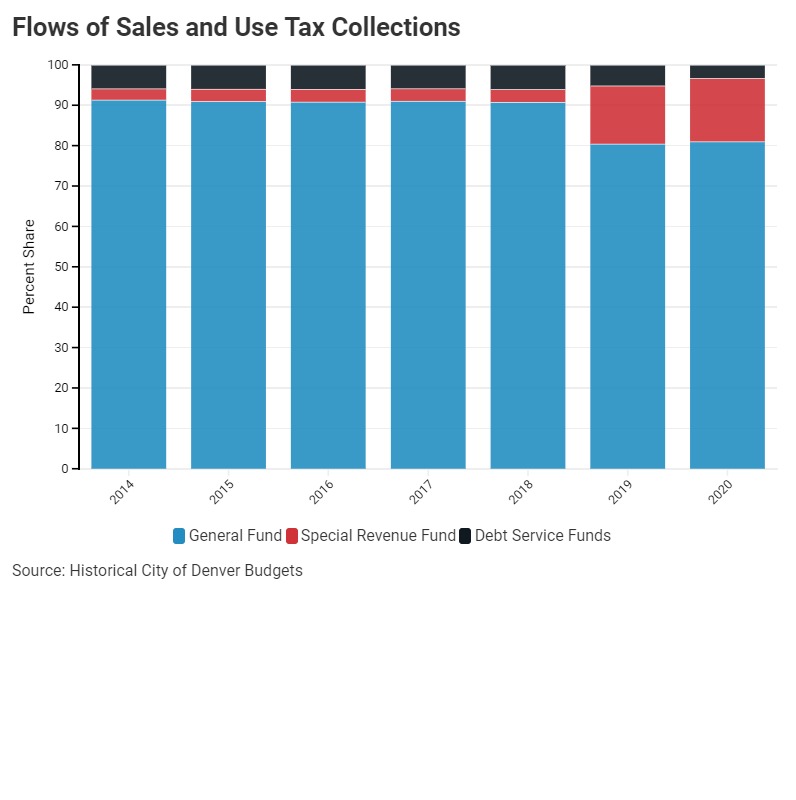

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

Nebraska Sales Tax Rates By City County 2022

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah

Aurora Colorado Sales Tax Rate Sales Taxes By City

U S Property Taxes Comparing Residential And Commercial Rates Across States

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Chicago Il Sales Tax Factory Sale 53 Off Www Ingeniovirtual Com

Aurora Kane County Illinois Sales Tax Rate

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute